Your pick of the years top gadgets

Some of the gadget highlights of the last 12 months include tablets, 3D TVs, apps and smartphones with more advanced features than ever.

Durning 2010 we've reviewed a wide selection of phones, laptops, TVs and tablets on T3.com and in T3 magazine. You can read what our reviewers thought in our Five Star Gadgets of 2010 review, but what about your choices? Click on the link below to view (in no particular order) 10 of the most popular T3 reader gadgets of 2010. Will your favourites be there?

LG 42LE4900 review

Posted by Videos at 8:46 AM

Stylish and affordable, but not quite a class act

The 42LE4900 is a slither of a screen . Taking advantage of LG’s diminutive spin on Edge LED backlighting, it stretches back less than 30mm. It’s also very affordable, retailing around £600 although this hasn’t dented the specification.

Given the budget nature of the TV, design is decidedly upmarket. We particularly like the central ‘Standby’ light above the pedestal. This glows red like a Cylon’s peeper, fidgeting when activated.

The LE4900 puts a friendly face forward. Once you’ve wrestled with the ironmongery that is the 20 degree swivel pedestal, you’re good to go. The screen has a well-thought out picture wizard, which allows you to quickly set correct black and white levels, sharpness and colour saturation.

Navigation is via LG’s simple tiled interface, and if that proves too unwieldy there’s a secondary Quick menu to scoot around. Both are equally intuitive, enlivened by clear, understandable graphics.

After months of neglect, LG’s Netcast online content offering has had a serious update. There’s now a healthy selection of free and PPV content to browse, including BBC iPlayer, YouTube, V Tuner internet radio, Acetrax, Facebook and Google maps.

Network media compatibility is also rather good. We had success streaming AVIs and MKVs, although one particular AVI test file was deemed ‘invalid’. File support from USB media is comparable.

Image quality, however, is unremarkable. Edge LED may enable the screen to achieve Cheryl Cole levels of slimness, but its execution is problematic. The backlight is clearly uneven, with bright peaks taunting you from each corner. The set’s inability to resolve fine motion detail also takes the shine off its Freeview HD channel performance - the LE4900 sorely misses the brand’s proprietary anti-blur TruMotion technology. Without it, there’s limited HD texture in faces and other moving objects. The set does have a Real Cinema anti-judder setting but this doesn’t resolve motion clarity. To avoid overscan, view HD sources in the Just Scan mode, available from the aspect ratio menu.

Audio is average, but that’s not through any lack of modes. There are Standard, Music, Cinema, Sport or Game presets, as well as LG’s proprietary Infinite Sound mode. This aspires to create a surround soundfield from the two downward firing speakers in the TV’s bezel. It doesn’t work, of course, but gets points for chutzpah.

Gorgeous to look at and surprisingly well equipped, but struggles to keep the Hi in Def

The 42LE4900 is a slither of a screen . Taking advantage of LG’s diminutive spin on Edge LED backlighting, it stretches back less than 30mm. It’s also very affordable, retailing around £600 although this hasn’t dented the specification.

Given the budget nature of the TV, design is decidedly upmarket. We particularly like the central ‘Standby’ light above the pedestal. This glows red like a Cylon’s peeper, fidgeting when activated.

The LE4900 puts a friendly face forward. Once you’ve wrestled with the ironmongery that is the 20 degree swivel pedestal, you’re good to go. The screen has a well-thought out picture wizard, which allows you to quickly set correct black and white levels, sharpness and colour saturation.

Navigation is via LG’s simple tiled interface, and if that proves too unwieldy there’s a secondary Quick menu to scoot around. Both are equally intuitive, enlivened by clear, understandable graphics.

After months of neglect, LG’s Netcast online content offering has had a serious update. There’s now a healthy selection of free and PPV content to browse, including BBC iPlayer, YouTube, V Tuner internet radio, Acetrax, Facebook and Google maps.

Network media compatibility is also rather good. We had success streaming AVIs and MKVs, although one particular AVI test file was deemed ‘invalid’. File support from USB media is comparable.

Image quality, however, is unremarkable. Edge LED may enable the screen to achieve Cheryl Cole levels of slimness, but its execution is problematic. The backlight is clearly uneven, with bright peaks taunting you from each corner. The set’s inability to resolve fine motion detail also takes the shine off its Freeview HD channel performance - the LE4900 sorely misses the brand’s proprietary anti-blur TruMotion technology. Without it, there’s limited HD texture in faces and other moving objects. The set does have a Real Cinema anti-judder setting but this doesn’t resolve motion clarity. To avoid overscan, view HD sources in the Just Scan mode, available from the aspect ratio menu.

Audio is average, but that’s not through any lack of modes. There are Standard, Music, Cinema, Sport or Game presets, as well as LG’s proprietary Infinite Sound mode. This aspires to create a surround soundfield from the two downward firing speakers in the TV’s bezel. It doesn’t work, of course, but gets points for chutzpah.

Gorgeous to look at and surprisingly well equipped, but struggles to keep the Hi in Def

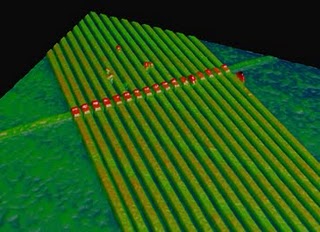

The Smart Grid

Posted by Videos at 8:40 AMCredit: Richard Cummins/Corbis

Electrical grids, the interconnected systems that transmit and distribute power, are at the heart of how we use energy. Yet despite their importance, in many places around the world these grids are falling apart. In the United States, while electricity demand increased by about 25 percent between 1990 and 1999, construction of transmission infrastructure decreased by 30 percent. Since then, annual investment in transmission has increased again, but much of the grid remains antiquated and overloaded.

Aging grids mean an unreliable electricity supply. They are also an obstacle to the use of renewable power sources such as wind and solar. It is estimated that generating electricity creates 11.4 billion tons of carbon emissions worldwide each year—nearly 40 percent of all energy-related carbon emissions. Renewable sources could reduce those emissions, but grids that were designed for a steady flow of power from fossil-fuel and nuclear plants have trouble dealing with the variable nature of wind and solar power.

Aging grids mean an unreliable electricity supply. They are also an obstacle to the use of renewable power sources such as wind and solar. It is estimated that generating electricity creates 11.4 billion tons of carbon emissions worldwide each year—nearly 40 percent of all energy-related carbon emissions. Renewable sources could reduce those emissions, but grids that were designed for a steady flow of power from fossil-fuel and nuclear plants have trouble dealing with the variable nature of wind and solar power.

Google Offers Cloud-Based Learning Engine

Posted by Videos at 6:30 AMProviding developers with machine learning on tap could unleash a flood of smarter apps.

From Amazon's product recommendations to Pandora's ability to find us new songs we like, the smartest Web services around rely on machine learning--algorithms that enable software to learn how to respond with a degree of intelligence to new information or events.

Now Google has launched a service that could bring such smarts to many more apps. Google Prediction API provides a simple way for developers to create software that learns how to handle incoming data. For example, the Google-hosted algorithms could be trained to sort e-mails into categories for "complaints" and "praise" using a dataset that provides many examples of both kinds. Future e-mails could then be screened by software using that API, and handled accordingly.

Currently just "hundreds" of developers have access to the service, says Travis Green, Google's product manager for Prediction API, "but already we can see people doing some amazing things." Users range from developers of mobile and Web apps to oil companies, he says. "Many want to do product recommendation, and there are also interesting NGO use cases with ideas such as extracting emergency information from Twitter or other sources online."

Machine learning is not an easy feature to build into software. Different algorithms and mathematical techniques work best for different kinds of data. Specialized knowledge of machine learning is typically needed to consider using it in a product, says Green Google's service provides a kind of machine-learning black box--data goes in one end, and predictions come out the other. There are three basic commands: one to upload a collection of data, another telling the service to learn what it can from it, and a third to submit new data for the system to react to based on what it learned.

"Developers can deploy it on their site or app within 20 minutes," says Green. "We're trying to provide a really easy service that doesn't require them to spend month after month trying different algorithms." Google's black box actually contains a whole suite of different algorithms. When data is uploaded, all of the algorithms are automatically applied to find out which works best for a particular job, and the best algorithm is then used to handle any new information submitted.

"Getting machine learning to a Google scale is significant," says Joel Confino, a software developer in Philadelphia who builds large-scale Web apps for banks and pharmaceutical companies, and a member of the preview program. He used Prediction API to quickly develop a simple yet effective spam e-mail filter, and he says the service has clear commercial potential.

Augmented Reality Lacks Bite for Marketers

Posted by Videos at 6:27 AM

Companies are experimenting with adding AR layers to real-world scenes. So far, it's not doing much to boost business.

ake out your smart phone and point its camera at the field. If the resulting image on your screen shows a giant Quiznos toaster floating above the grass, does that make you more inclined to go get a Quiznos sandwich?

How about if you were at Mount Rushmore and you saw the four carved presidents sipping cola from Quiznos cups? Would that influence your lunch plans? Or what if you were on Wall Street, and aiming your smart phone at a real-world statue of a bull yielded an image of it enjoying virtual nachos?

ake out your smart phone and point its camera at the field. If the resulting image on your screen shows a giant Quiznos toaster floating above the grass, does that make you more inclined to go get a Quiznos sandwich?

How about if you were at Mount Rushmore and you saw the four carved presidents sipping cola from Quiznos cups? Would that influence your lunch plans? Or what if you were on Wall Street, and aiming your smart phone at a real-world statue of a bull yielded an image of it enjoying virtual nachos?

Flexible Printed Electronics Advance

Posted by Videos at 6:26 AMWonder material graphene wins Nobel Prize, flexible electronics head to market, and advances hint at the future of displays. single-atom-thick carbon material (Graphene Wins Nobel Prize), Andre Geim and Konstantin Novoselov, both in the physics department at the University of Manchester, have received the 2010 Nobel Prize in Physics.

Perhaps one reason the prize was bestowed so soon after the work it recognizes is that materials scientists have already taken graphene from basic science experiments to prototypes of new devices. In one noteworthy example from this year, researchers at IBM made graphene transistor arrays that operate at 100 gigahertz—switching on and off 100 billion times each second, about 10 times as fast as the speediest silicon transistors (Graphene Transistors that Can Work at Blistering Speeds). Work at Samsung capitalized on graphene's conductivity and flexibility to make flexible touch screens (Flexible Touch Screen Made with Printed Graphene).

Flexible Printed Electronics Advance

Other flexible materials for electronics also saw progress this year. Working with carbon nanotubes, researchers at Northwestern University and the University of Minnesota made the fastest printed electronics yet (Record Performance for Printed Electronics). Printed electronics holds out the promise of flexible devices that can be fabricated at high volume and low cost. Researchers at HP continued their work scaling up flexible display drivers made from thin films of silicon on rolls of plastic (Inexpensive, Unbreakable Displays and A Flexible Color Display). Meanwhile, groups at Stanford and the University of California, Berkeley, printed pressure sensors that match the sensitivity of human skin (Electric Skin that Rivals the Real Thing and Printing Electronic Skin).

3-D TVs, Cameras, and Camcorders Galore

Posted by Videos at 6:24 AM3-D and augmented reality made it big in 2010—with a few pitfalls.

3-D TVs, Cameras, and Camcorders Galore

3-D was a hot topic at the start of the year, partly because of the 3-D blockbuster movie Avatar, which came out last December. Many predicted that 3-D technology would move quickly from the movie theater into the home, and major electronics companies including Panasonic, Mitsubishi, Sony, Philips, and Toshiba announced plans to release 3-D televisions and Blu-ray players (Home 3-D: Here, or Hype? and Here Come the High-Definition 3-D TVs). But obstacles—particularly the need to wear 3-D glasses costing upwards of $100 per pair and the limited amount of 3-D content available to watch (a handful of DVDs and few TV transmissions)—have prevented 3-D TVs from becoming wildly popular, at least for now (Will 3-D Make the Jump from Theater to Living Room?).

In an effort to make the technology more enticing, some companies are developing glasses-free 3-D displays. Each lens in a pair of 3-D glasses filters a different image, which fools the brain into responding as if to a three-dimensional image. To ditch the glasses, the display has to produce alternating images very rapidly, and the user has to sit in just the right place relative to the screen. While most people would prefer not to have to wear 3-D glasses, few will be happy with this constraint. Fortunately, Microsoft has figured out a way around the problem—a screen that detects the viewer's position and shows different images to each eye. Although it's still in the research stages, the technology will allow one or two people to see a 3-D image on a screen, regardless of where in the room they are sitting

About Solar Research NGO

Posted by Videos at 6:21 AMSolar Research NGO Project is completely a welfare project. It is for the welfare of whole nation of our dear coutnry Pakistan. We are trying to design,devlop and research to transfer the fuel & battery system onto Solar Energy System. It is going to be a big challenge to do all these things within Pakistan. But we are confident and believe over ourselves and our expertise and mainly Allah, so in the end, this will be done INSHALLAH. We want to thank the people who are co-operating with us for this purpose and helping us.

Objectives of Solar Research NGO

- Promote Solar Energy in Pakistan.

- Developing Environment Health.

- Transfering Private & Public Transport onto Solar Energy, So that it'll be very cheap and people will get great relief in their lives.

- Removing Poverty, Poor people will also afford to go any where in the country without paying much.

- Improving business of every citizen of the country, when transportation will be cheap and loadshading will be UNAVAILABLE!

- More employment opportunities will be created.

- Polution free Pakistan.

Solar Energy: An Over View

Posted by Videos at 6:11 AM

As solar power does not make sense for all locations in the world. The initial cost of installing solar panels or other sources of solar energy is high, and that is not easy for most people to get around. No matter how much some people would like to get involved in the movement to independent energy, it is cost prohibitive.To achieve the highest level of efficiency, which is the entire point of going solar in the first place, you need the proper amount of roof space to support the panels your house may require. Not only how much space is available, but also the location of your home is also relevant to whether or not you can maintain solar energy. Some houses simply do not receive enough sunlight to produce substantial energy. This could mean that either your house is not positioned favorably in relation to a tree or other house.

Pakistan is most suitable for solar power:

As you can see, the cons of implementing solar power in your home are primarily cost and location related, but if those two items do not pose issues for you, the good news is…

If solar power is looked at through a long-term lens, you will eventually make back what you originally spent, and possibly start saving money on your investment

Let’s not forget that solar energy increases the value of your home too. Solar power is not subject supply and demand fluctuations in the way that gas is. Silicon, the primary component of solar panels, is also being more widely produced, therefore, less and less expensive with each passing year.

Solar power is independent, or semi-independent. This is great because you can supply your home with electricity during a power outage. Solar power can also be used in remote locations, places where conventional power can’t be reached. On a larger scale, solar power also reduces our need to rely on foreign sources for power.

And last, but certainly not least, it’s good for our planet! Solar energy is clean, renewable and sustainable. It does not fill our atmosphere with carbon dioxide, nitrogen oxide, mercury or any other pollutants. It is a free and unlimited source of power, unlike expensive and damaging fossil fuels.

Efficient market hypothesis

Posted by Videos at 11:28 PMEfficient market hypothesis

The efficient market hypothesis (EMH) contradicts the basic tenets of technical analysis by stating that past prices cannot be used to profitably predict future prices. Thus it holds that technical analysis cannot be effective. Economist Eugene Fama published the seminal paper on the EMH in the Journal of Finance in 1970, and said "In short, the evidence in support of the efficient markets model is extensive, and (somewhat uniquely in economics) contradictory evidence is sparse."[35] EMH advocates say that if prices quickly reflect all relevant information, no method (including technical analysis) can "beat the market." Developments which influence prices occur randomly and are unknowable in advance.Technicians say that EMH ignores the way markets work, in that many investors base their expectations on past earnings or track record, for example. Because future stock prices can be strongly influenced by investor expectations, technicians claim it only follows that past prices influence future prices.[36] They also point to research in the field of behavioral finance, specifically that people are not the rational participants EMH makes them out to be. Technicians have long said that irrational human behavior influences stock prices, and that this behavior leads to predictable outcomes.[37] Author David Aronson says that the theory of behavioral finance blends with the practice of technical analysis:

By considering the impact of emotions, cognitive errors, irrational preferences, and the dynamics of group behavior, behavioral finance offers succinct explanations of excess market volatility as well as the excess returns earned by stale information strategies.... cognitive errors may also explain the existence of market inefficiencies that spawn the systematic price movements that allow objective TA [technical analysis] methods to work.[36]EMH advocates reply that while individual market participants do not always act rationally (or have complete information), their aggregate decisions balance each other, resulting in a rational outcome (optimists who buy stock and bid the price higher are countered by pessimists who sell their stock, which keeps the price in equilibrium).[38] Likewise, complete information is reflected in the price because all market participants bring their own individual, but incomplete, knowledge together in the market.[38]

Random walk hypothesis

The random walk hypothesis may be derived from the weak-form efficient markets hypothesis, which is based on the assumption that market participants take full account of any information contained in past price movements (but not necessarily other public information). In his book A Random Walk Down Wall Street, Princeton economist Burton Malkiel said that technical forecasting tools such as pattern analysis must ultimately be self-defeating: "The problem is that once such a regularity is known to market participants, people will act in such a way that prevents it from happening in the future."[39]In the late 1980's, professors Andrew Lo and Craig McKinlay published a paper which casts doubt on the random walk hypothesis. In a 1999 response to Malkiel, Lo and McKinlay collected empirical papers that questioned the hypothesis' applicability[40] that suggested a non-random and possibly predictive component to stock price movement, though they were careful to point out that rejecting random walk does not necessarily invalidate EMH, an entirely separate concept from RWH.

Technicians say that the EMH and random walk theories both ignore the realities of markets, in that participants are not completely rational and that current price moves are not independent of previous moves.

Charting terms and indicators

Concepts

- Resistance — a price level that may prompt a net increase of selling activity

- Support — a price level that may prompt a net increase of buying activity

- Breakout — the concept whereby prices forcefully penetrate an area of prior support or resistance, usually, but not always, accompanied by an increase in volume.

- Trending — the phenomenon by which price movement tends to persist in one direction for an extended period of time

- Average true range — averaged daily trading range, adjusted for price gaps

- Chart pattern — distinctive pattern created by the movement of security prices on a chart

- Dead cat bounce — the phenomenon whereby a spectacular decline in the price of a stock is immediately followed by a moderate and temporary rise before resuming its downward movement

- Elliott wave principle and the golden ratio to calculate successive price movements and retracements

- Fibonacci ratios — used as a guide to determine support and resistance

- Momentum — the rate of price change

- Point and figure analysis — A priced-based analytical approach employing numerical filters which may incorporate time references, though ignores time entirely in its construction.

- Cycles - time targets for potential change in price action (price only moves up, down, or sideways)

Types of charts

- OHLC "Bar Charts" — Open-High-Low-Close charts, also known as bar charts, plot the span between the high and low prices of a trading period as a vertical line segment at the trading time, and the open and close prices with horizontal tick marks on the range line, usually a tick to the left for the open price and a tick to the right for the closing price.

- Candlestick chart — Of Japanese origin and similar to OHLC, candlesticks widen and fill the interval between the open and close prices to emphasize the open/close relationship. In the West, often black or red candle bodies represent a close lower than the open, while white, green or blue candles represent a close higher than the open price.

- Line chart — Connects the closing price values with line segments.

- Point and figure chart — a chart type employing numerical filters with only passing references to time, and which ignores time entirely in its construction.

Overlays

Overlays are generally superimposed over the main price chart.- Resistance — a price level that may act as a ceiling above price

- Support — a price level that may act as a floor below price

- Trend line — a sloping line described by at least two peaks or two troughs

- Channel — a pair of parallel trend lines

- Moving average — the last n-bars of price divided by "n" -- where "n" is the number of bars specified by the length of the average. A moving average can be thought of as a kind of dynamic trend-line.

- Bollinger bands — a range of price volatility

- Parabolic SAR — Wilder's trailing stop based on prices tending to stay within a parabolic curve during a strong trend

- Pivot point — derived by calculating the numerical average of a particular currency's or stock's high, low and closing prices

- Ichimoku kinko hyo — a moving average-based system that factors in time and the average point between a candle's high and low

Price-based indicators

These indicators are generally shown below or above the main price chart.- Advance decline line — a popular indicator of market breadth

- Average Directional Index — a widely used indicator of trend strength

- Commodity Channel Index — identifies cyclical trends

- MACD — moving average convergence/divergence

- Relative Strength Index (RSI) — oscillator showing price strength

- Stochastic oscillator — close position within recent trading range

- Trix — an oscillator showing the slope of a triple-smoothed exponential moving average

- Momentum — the rate of price change

Volume-based indicators

Trading strategy

Posted by Videos at 11:09 PMIn finance, a trading strategy (see also trading system) is a predefined set of rules for making trading decisions.

Traders, investment firms and fund managers use a trading strategy to help make wiser investment decisions and help eliminate the emotional aspect of trading. A trading strategy is governed by a set of rules that do not deviate. Emotional bias is eliminated because the systems operate within the parameters known by the trader. The parameters can be trusted based on historical analysis (backtesting) and real world market studies (forward testing), so that the trader can have confidence in the strategy and its operating characteristics.

An automated trading strategy wraps trading formulas into automated order and execution systems. Advanced computer modeling techniques, combined with electronic access to world market data and information, enable traders using a trading strategy to have a unique market vantage point. A trading strategy can automate all or part of your investment portfolio. Computer trading models can be adjusted for either conservative or aggressive trading styles.

Traders, investment firms and fund managers use a trading strategy to help make wiser investment decisions and help eliminate the emotional aspect of trading. A trading strategy is governed by a set of rules that do not deviate. Emotional bias is eliminated because the systems operate within the parameters known by the trader. The parameters can be trusted based on historical analysis (backtesting) and real world market studies (forward testing), so that the trader can have confidence in the strategy and its operating characteristics.

Development

When developing a trading strategy, many things must be considered: return, risk, volatility, timeframe, style, correlation with the markets, methods, etc. After developing a strategy, it can be backtested using computer programs. Although backtesting is no guarantee of future performance, it gives the trader confidence that the strategy has worked in the past. If the strategy is not over-optimized, data-mined, or based on random coincidences, it might have a good chance of working in the future.Executing strategies

A trading strategy can be executed by a trader (manually) or automated (by computer). Manual trading requires a great deal of skill and discipline. It is tempting for the trader to deviate from the strategy, which usually reduces its performance.An automated trading strategy wraps trading formulas into automated order and execution systems. Advanced computer modeling techniques, combined with electronic access to world market data and information, enable traders using a trading strategy to have a unique market vantage point. A trading strategy can automate all or part of your investment portfolio. Computer trading models can be adjusted for either conservative or aggressive trading styles.

comments (0)

Trader (finance)

Posted by Videos at 10:58 PMIn finance, a trader is someone who buys and sells finnacial instrument such as stocks, bonds, commodities and derevative. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to theWall Street Journal in 2004, a managing director convertible-bond trader was earning between $700,000 and $900,000 on average.

Traders are either professionals working in a financial institution or a corporation, or individual investor, or day traders. They buy and sell financial instruments traded in the stock markets, derivatives markets andcommodity markets, comprising the stock exchange ,derivatives exchanges and thecommodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, these may include:

Traders are either professionals working in a financial institution or a corporation, or individual investor, or day traders. They buy and sell financial instruments traded in the stock markets, derivatives markets andcommodity markets, comprising the stock exchange ,derivatives exchanges and thecommodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, these may include:

- stock trader

- day trader

- pattern day trader

- floor trader

- High-frequency trader

- rogue trader

Industry,Use,Systematic trading,Neural networks

Posted by Videos at 11:23 PMIndustry

The industry is globally represented by the International Federation of Technical Analysts (IFTA), which is a Federation of regional and national organizations and the Market Technicians Association (MTA). In the United States, the industry is represented by both the Market Technicians Association (MTA) and the American Association of Professional Technical Analysts (AAPTA). The United States is also represented by the Technical Security Analysts Association of San Francisco (TSAASF). In the United Kingdom, the industry is represented by the Society of Technical Analysts (STA). In Canada the industry is represented by the Canadian Society of Technical Analysts. Some other national professional technical analysis organizations are noted in the external links section below.Professional technical analysis societies have worked on creating a body of knowledge that describes the field of Technical Analysis. A body of knowledge is central to the field as a way of defining how and why technical analysis may work. It can then be used by academia, as well as regulatory bodies, in developing proper research and standards for the field. The Market Technicians Association (MTA) has published a body of knowledge, which is the structure for the MTA's Chartered Market Technician (CMT) exam.

Use

Traders generally share the view that trading in the direction of the trend is the most effective means to be profitable in financial or commodities markets. John W. Henry, Larry Hite, Ed Seykota, Richard Dennis, William Eckhardt, Victor Sperandeo, Michael Marcus and Paul Tudor Jones (some of the so-called Market Wizards in the popular book of the same name by Jack D. Schwager) have each amassed massive fortunes via the use of technical analysis and its concepts. George Lane, a technical analyst, coined one of the most popular phrases on Wall Street, "The trend is your friend!"Many non-arbitrage algorithmic trading systems rely on the idea of trend-following, as do many hedge funds. A relatively recent trend, both in research and industrial practice, has been the development of increasingly sophisticated automated trading strategies. These often rely on underlying technical analysis principles (see algorithmic trading article for an overview).

Systematic trading

Neural networks

Since the early 1990s when the first practically usable types emerged, artificial neural networks (ANNs) have rapidly grown in popularity. They are artificial intelligence adaptive software systems that have been inspired by how biological neural networks work. They are used because they can learn to detect complex patterns in data. In mathematical terms, they are universal function approximators,[21][22] meaning that given the right data and configured correctly, they can capture and model any input-output relationships. This not only removes the need for human interpretation of charts or the series of rules for generating entry/exit signals, but also provides a bridge to fundamental analysis, as the variables used in fundamental analysis can be used as input.As ANNs are essentially non-linear statistical models, their accuracy and prediction capabilities can be both mathematically and empirically tested. In various studies, authors have claimed that neural networks used for generating trading signals given various technical and fundamental inputs have significantly outperformed buy-hold strategies as well as traditional linear technical analysis methods when combined with rule-based expert systems.[23][24][25]

While the advanced mathematical nature of such adaptive systems has kept neural networks for financial analysis mostly within academic research circles, in recent years more user friendly neural network software has made the technology more accessible to traders. However, large-scale application is problematic because of the problem of matching the correct neural topology to the market being studied.

Rule-based trading

Rule-based trading is an approach intended to create trading plans using strict and clear-cut rules. Unlike some other technical methods and the approach of fundamental analysis, it defines a set of rules that determine all trades, leaving minimal discretion. The theory behind this approach is that by following a distinct set of trading rules you will reduce the number of poor decisions, which are often emotion based.For instance, a trader might make a set of rules stating that he will take a long position whenever the price of a particular instrument closes above its 50-day moving average, and shorting it whenever it drops below.

Combination with other market forecast methods

John Murphy states that the principal sources of information available to technicians are price, volume and open interest.[26] Other data, such as indicators and sentiment analysis, are considered secondary.However, many technical analysts reach outside pure technical analysis, combining other market forecast methods with their technical work. One advocate for this approach is John Bollinger, who coined the term rational analysis in the middle 1980s for the intersection of technical analysis and fundamental analysis.[1] Another such approach, fusion analysis, [2] overlays fundamental analysis with technical, in an attempt to improve portfolio manager performance.

Technical analysis is also often combined with quantitative analysis and economics. For example, neural networks may be used to help identify intermarket relationships.[3] A few market forecasters combine financial astrology with technical analysis. Chris Carolan's article "Autumn Panics and Calendar Phenomenon", which won the Market Technicians Association Dow Award for best technical analysis paper in 1998, demonstrates how technical analysis and lunar cycles can be combined.[4] Calendar phenomena, such as the January effect in the stock market, are generally believed to be caused by tax and accounting related transactions, and are not related to the subject of financial astrology.

Investor and newsletter polls, and magazine cover sentiment indicators, are also used by technical analysts.[5]

Empirical evidence

Whether technical analysis actually works is a matter of controversy. Methods vary greatly, and different technical analysts can sometimes make contradictory predictions from the same data. Many investors claim that they experience positive returns, but academic appraisals often find that it has little predictive power.[27] Modern studies may be more positive: of 95 modern studies, 56 concluded that technical analysis had positive results, although data-snooping bias and other problems make the analysis difficult.[6] Nonlinear prediction using neural networks occasionally produces statistically significant prediction results.[28] A Federal Reserve[14] regarding working papersupport and resistance levels in short-term foreign exchange rates "offers strong evidence that the levels help to predict intraday trend interruptions," although the "predictive power" of those levels was "found to vary across the exchange rates and firms examined".Technical trading strategies were found to be effective in the Chinese marketplace by a recent study that states, "Finally, we find significant positive returns on buy trades generated by the contrarian version of the moving average crossover rule, the channel breakout rule, and the Bollinger band trading rule, after accounting for transaction costs of 0.50 percent."[29]

An influential 1992 study by Brock et al. which appeared to find support for technical trading rules was tested for data snooping and other problems in 1999;[30] the sample covered by Brock et al. was robust to data snooping.

Subsequently, a comprehensive study of the question by Amsterdam economist Gerwin Griffioen concludes that: "for the U.S., Japanese and most Western European stock market indices the recursive out-of-sample forecasting procedure does not show to be profitable, after implementing little transaction costs. Moreover, for sufficiently high transaction costs it is found, by estimating CAPMs, that technical trading shows no statistically significant risk-corrected out-of-sample forecasting power for almost all of the stock market indices."[9] Transaction costs are particularly applicable to "momentum strategies"; a comprehensive 1996 review of the data and studies concluded that even small transaction costs would lead to an inability to capture any excess from such strategies.[31]

In a paper published in the Journal of Finance, Dr. Andrew W. Lo, director MIT Laboratory for Financial Engineering, working with Harry Mamaysky and Jiang Wang found that "Technical analysis, also known as "charting," has been a part of financial practice for many decades, but this discipline has not received the same level of academic scrutiny and acceptance as more traditional approaches such as fundamental analysis. One of the main obstacles is the highly subjective nature of technical analysis—the presence of geometric shapes in historical price charts is often in the eyes of the beholder. In this paper, we propose a systematic and automatic approach to technical pattern recognition using nonparametric kernel regression, and apply this method to a large number of U.S. stocks from 1962 to 1996 to evaluate the effectiveness of technical analysis. By comparing the unconditional empirical distribution of daily stock returns to the conditional distribution—conditioned on specific technical indicators such as head-and-shoulders or double-bottoms—we find that over the 31-year sample period, several technical indicators do provide incremental information and may have some practical value."[32] In that same paper Dr. Lo wrote that "several academic studies suggest that ... technical analysis may well be an effective means for extracting useful information from market prices."[33] Some techniques such as Drummond Geometry attempt to overcome the past data bias by projecting support and resistance levels from differing time frames into the near-term future and combining that with reversion to the mean techniques.[34]

Technical analysis

Posted by Videos at 11:15 PMHistory

The principles of technical analysis derive from the observation of financial markets over hundreds of years.[2] The oldest known hints of technical analysis appear in Joseph de la Vega's accounts of the Dutch markets in the 17th century. In Asia, the oldest example of technical analysis is thought to be a method developed by Homma Munehisa during early 18th century which evolved into the use of candlestick techniques, and is today a main charting tool.[3][4] In the 1920s and 1930s Richard W. Schabacker published several books which continued the work of Dow and William Peter Hamilton: Stock Market Theory and Practice, Technical Market Analysis... At the end of his life he was joined by his brother in law, Robert D. Edwards who finished his last book. In 1948 Edwards and John Magee published Technical Analysis of Stock Trends (ISBN 9780849337727) which is widely considered to be one of the seminal works of the discipline. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. It is now in its 9th edition. As is obvious, early technical analysis was almost exclusively the analysis of charts, because the processing power of computers was not available for statistical analysis. Charles Dow reportedly originated a form of chart analysis used by technicians -- point and figure analysis.Dow Theory is based on the collected writings of Dow Jones co-founder and editor Charles Dow, and inspired the use and development of modern technical analysis from the end of the 19th century. Other pioneers of analysis techniques include Ralph Nelson Elliott, William Delbert Gann and Richard Wyckoff who developed their respective techniques in the early 20th century.

Many more technical tools and theories have been developed and enhanced in recent decades, with an increasing emphasis on computer-assisted techniques.

General description

While fundamental analysts examine earnings, dividends, new products, research and the like, technical analysts examine what investors fear or think about those developments and whether or not investors have the wherewithall to back up their opinions; these two concepts are called psych (psychology) and supply/demand. In the M = P/E equation, technicians assess M, the multiple investors do/may pay - if they have the money - for the fundamentals they envision. Technicians employ many techniques, one of which is the use of charts. Using charts, technical analysts seek to identify price patterns and market trends in financial markets and attempt to exploit those patterns.[5] Technicians use various methods and tools, the study of price charts is but one.Supply/demand indicators monitor investors' liquidity; margin levels, short interest, cash in brokerage accounts, etc., in an attempt to determine whether they have any money left. Other indicators monitor the state of psych - are investors bullish or bearish? - and are they willing to spend money to back up their beliefs. A spent-out bull cannot move the market higher, and a well heeled bear won't!; investors need to know which they are facing. In the end, stock prices are only what investors think; therefore determining what they think is every bit as critical as an earnings estimate.

Technicians using charts search for archetypal price chart patterns, such as the well-known head and shoulders or double top/bottom reversal patterns, study technical indicators, moving averages, and look for forms such as lines of support, resistance, channels, and more obscure formations such as flags, pennants, balance days and cup and handle patterns.

Technical analysts also widely use market indicators of many sorts, some of which are mathematical transformations of price, often including up and down volume, advance/decline data and other inputs. These indicators are used to help access whether an asset is trending, and if it is, its probability of its direction and of continuation. Technicians also look for relationships between price/volume indices and market indicators. Examples include the relative strength index, and MACD. Other avenues of study include correlations between changes in options (implied volatility) and put/call ratios with price. Also important are sentiment indicators such as Put/Call ratios, bull/bear ratios, short interest and Implied Volatility, etc.

There are many techniques in technical analysis. Adherents of different techniques (for example, candlestick charting, Dow Theory, and Elliott wave theory) may ignore the other approaches, yet many traders combine elements from more than one technique. Some technical analysts use subjective judgment to decide which pattern(s) a particular instrument reflects at a given time, and what the interpretation of that pattern should be. Others employ a strictly mechanical or systematic approach to pattern identification and interpretation.

Technical analysis is frequently contrasted with fundamental analysis, the study of economic factors that influence the way investors price financial markets. Technical analysis holds that prices already reflect all such trends before investors are aware of them. Uncovering those trends is what technical indicators are designed to do, imperfect as they may be. Fundamental indicators are subject to the same limitations, naturally. Some traders use technical or fundamental analysis exclusively, while others use both types to make trading decisions which conceivably is the most rational approach.

Users of technical analysis are often called technicians or market technicians. Some prefer the term technical market analyst or simply market analyst. An older term, chartist, is sometimes used, but as the discipline has expanded and modernized, the use of the term chartist has become less popular, as it is only one aspect of technical analysis.[citation needed]

Characteristics

Technical analysis employs models and trading rules based on price and volume transformations, such as the relative strength index, moving averages, regressions, inter-market and intra-market price correlations, cycles or, classically, through recognition of chart patterns.Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Technical analysis analyses price, volume and other market information, whereas fundamental analysis looks at the actual facts of the company, market, currency or commodity. Most large brokerage, trading group, or financial institution will typically have both a technical analysis and fundamental analysis team.

Technical analysis is widely used among traders and financial professionals, and is very often used by active day traders, market makers, and pit traders. In the 1960s and 1970s it was widely dismissed by academics. In a recent review, Irwin and Park[6] reported that 56 of 95 modern studies found it produces positive results, but noted that many of the positive results were rendered dubious by issues such as data snooping so that the evidence in support of technical analysis was inconclusive, although experienced traders consider 40% profitable trades a positive result; it is still considered by many academics to be pseudoscience.[7] Academics such as Eugene Fama say the evidence for technical analysis is sparse and is inconsistent with the weak form of the efficient-market hypothesis.[8][9] Users hold that even if technical analysis cannot predict the future, it helps to identify trading opportunities.[10]

In the foreign exchange markets, its use may be more widespread than fundamental analysis.[11][12] This does not mean technical analysis is more applicable to foreign markets, but that technical analysis is more recognized there as to its efficacy there than elsewhere. While some isolated studies have indicated that technical trading rules might lead to consistent returns in the period prior to 1987,[13][14][15][16] most academic work has focused on the nature of the anomalous position of the foreign exchange market.[17] It is speculated that this anomaly is due to central bank intervention, which obviously technical analysis is not designed to predict.[18] Recent research suggests that combining various trading signals into a Combined Signal Approach may be able to increase profitability and reduce dependence on any single rule.[19]

Principles

Market action discounts everything

Based on the premise that all relevant information is already reflected by prices, technical analysts believe it is important to understand what investors think of that information, known and perceived; studies such as by Cutler, Poterba, and Summers titled "What Moves Stock Prices?" do not cover this aspect of investing.Prices move in trends

See also: Market trend

Technical analysts believe that prices trend directionally, i.e., up, down, or sideways (flat) or some combination. The basic definition of a price trend was originally put forward by Dow Theory.[5]An example of a security that had an apparent trend is AOL from November 2001 through August 2002. A technical analyst or trend follower recognizing this trend would look for opportunities to sell this security. AOL consistently moves downward in price. Each time the stock rose, sellers would enter the market and sell the stock; hence the "zig-zag" movement in the price. The series of "lower highs" and "lower lows" is a tell tale sign of a stock in a down trend.[20] In other words, each time the stock moved lower, it fell below its previous relative low price. Each time the stock moved higher, it could not reach the level of its previous relative high price.

Note that the sequence of lower lows and lower highs did not begin until August. Then AOL makes a low price that doesn't pierce the relative low set earlier in the month. Later in the same month, the stock makes a relative high equal to the most recent relative high. In this a technician sees strong indications that the down trend is at least pausing and possibly ending, and would likely stop actively selling the stock at that point.

History tends to repeat itself

Technical analysts believe that investors collectively repeat the behavior of the investors that preceded them. "Everyone wants in on the next Microsoft," "If this stock ever gets to $50 again, I will buy it," "This company's technology will revolutionize its industry, therefore this stock will skyrocket" – these are all examples of investor sentiment repeating itself. To a technician, the emotions in the market may be irrational, but they exist. Because investor behavior repeats itself so often, technicians believe that recognizable (and predictable) price patterns will develop on a chart.[5]Technical analysis is not limited to charting, but it always considers price trends. For example, many technicians monitor surveys of investor sentiment. These surveys gauge the attitude of market participants, specifically whether they are bearish or bullish. Technicians use these surveys to help determine whether a trend will continue or if a reversal could develop; they are most likely to anticipate a change when the surveys report extreme investor sentiment. Surveys that show overwhelming bullishness, for example, are evidence that an uptrend may reverse – the premise being that if most investors are bullish they have already bought the market (anticipating higher prices). And because most investors are bullish and invested, one assumes that few buyers remain. This leaves more potential sellers than buyers, despite the bullish sentiment. This suggests that prices will trend down, and is an example of contrarian trading.

Trading strategy

Posted by Videos at 11:09 PM

In finance, a trading strategy (see also trading system) is a predefined set of rules for making trading decisions.

Traders, investment firms and fund managers use a trading strategy to help make wiser investment decisions and help eliminate the emotional aspect of trading. A trading strategy is governed by a set of rules that do not deviate. Emotional bias is eliminated because the systems operate within the parameters known by the trader. The parameters can be trusted based on historical analysis (backtesting) and real world market studies (forward testing), so that the trader can have confidence in the strategy and its operating characteristics.

An automated trading strategy wraps trading formulas into automated order and execution systems. Advanced computer modeling techniques, combined with electronic access to world market data and information, enable traders using a trading strategy to have a unique market vantage point. A trading strategy can automate all or part of your investment portfolio. Computer trading models can be adjusted for either conservative or aggressive trading styles.

Traders, investment firms and fund managers use a trading strategy to help make wiser investment decisions and help eliminate the emotional aspect of trading. A trading strategy is governed by a set of rules that do not deviate. Emotional bias is eliminated because the systems operate within the parameters known by the trader. The parameters can be trusted based on historical analysis (backtesting) and real world market studies (forward testing), so that the trader can have confidence in the strategy and its operating characteristics.

Development

When developing a trading strategy, many things must be considered: return, risk, volatility, timeframe, style, correlation with the markets, methods, etc. After developing a strategy, it can be backtested using computer programs. Although backtesting is no guarantee of future performance, it gives the trader confidence that the strategy has worked in the past. If the strategy is not over-optimized, data-mined, or based on random coincidences, it might have a good chance of working in the future.Executing strategies

A trading strategy can be executed by a trader (manually) or automated (by computer). Manual trading requires a great deal of skill and discipline. It is tempting for the trader to deviate from the strategy, which usually reduces its performance.An automated trading strategy wraps trading formulas into automated order and execution systems. Advanced computer modeling techniques, combined with electronic access to world market data and information, enable traders using a trading strategy to have a unique market vantage point. A trading strategy can automate all or part of your investment portfolio. Computer trading models can be adjusted for either conservative or aggressive trading styles.

Trader (finance)

Posted by Videos at 10:58 PM

In finance, a trader is someone who buys and sells finnacial instrument such as stocks, bonds, commodities and derevative. A broker who simply fills buy or sell orders is not a trader, as they are merely executing instructions given to them. According to theWall Street Journal in 2004, a managing director convertible-bond trader was earning between $700,000 and $900,000 on average.

Traders are either professionals working in a financial institution or a corporation, or individual investor, or day traders. They buy and sell financial instruments traded in the stock markets, derivatives markets andcommodity markets, comprising the stock exchange ,derivatives exchanges and thecommodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, these may include:

Traders are either professionals working in a financial institution or a corporation, or individual investor, or day traders. They buy and sell financial instruments traded in the stock markets, derivatives markets andcommodity markets, comprising the stock exchange ,derivatives exchanges and thecommodities exchanges. Several categories and designations for diverse kinds of traders are found in finance, these may include:

- stock trader

- day trader

- pattern day trader

- floor trader

- High-frequency trader

- rogue trader

Vista PCs with downgrade option? Is Windows Vista really that disappointing

Posted by Videos at 11:13 PM

I just stumbled across some very hilarious news from coolest-gadgets.com that users who bought their PCs which came bundled with either Microsoft Windows Vista Business or Ultimate edition are now being offered the option to downgrade back to Windows XP!

So what’s the difference between Vista Business and Ultimate? Well, briefly speaking, “Business includes features, such as simpler troubleshooting and support for domains, which can reduce your costs while increasing your long-term IT growth potential.” Business edition currently costs $299.95 dollars to buy in full and $199.95 to upgrade. While the Ultimate edition is really the most complete edition of Windows Vista available —”with the power, security, and mobility features that you need for work, and all of the entertainment features that you want for fun.” The Ultimate costs $399.95 for the full and $259.95 for the upgrade.

More after the jump…

So what’s the difference between Vista Business and Ultimate? Well, briefly speaking, “Business includes features, such as simpler troubleshooting and support for domains, which can reduce your costs while increasing your long-term IT growth potential.” Business edition currently costs $299.95 dollars to buy in full and $199.95 to upgrade. While the Ultimate edition is really the most complete edition of Windows Vista available —”with the power, security, and mobility features that you need for work, and all of the entertainment features that you want for fun.” The Ultimate costs $399.95 for the full and $259.95 for the upgrade.

More after the jump…

A toaster that writes – behold the toaster messenger!

Posted by Videos at 11:12 PMCheck out this new modern toaster design, by Sasha Tseng, leave messages to your family when they wake up for breakfast. The idea is to inscribe messages onto your toast simply by writing on the writing pad provided. This really brings a new meaning to the catchphrase “Eat my words”.

Click here to visit the designer, Sasha Tseng’s toaster messenger page.

Behold the Lamborghini Reventon (+short video clip)!

Posted by Videos at 11:10 PMNamed after a raging bull…concept based on jet fighter planes… the all new limited edition Lambo Reventon has a 6.5L V12 engine, an output of 650 horsepower, along with all wheel drive, this ultimate machine will only be produced in a limited quantity of 20 units! Each costs one million euros, but I’m afraid they have all been sold out!

Sports caps for new Apple iPod Nanos by iXoundWear

Posted by Videos at 11:09 PMWhat’s the latest in technology and fashion accessory recently? Well of course the new Apple iPods! And if you’re interested in getting the new third generation of Apple iPod Nanos, you should probably have a look at this too:

iXoundWear has designed a sports cap for the latest iPod Nano, simply slip your Nano into the pocket provided over the right hand side of your cap and you’re ready to attract loads of attention! :] Though the caps aren’t available yet, but the source tells us that the caps will be available in five different colours to match your iPod, from November

Here’s the official page from iXoundWear: iXoundWear Sport Cap for iPod? Nano 3rd Generation

Volkner Mobil’s latest luxury RV with built-in garage

Posted by Videos at 11:09 PM

Have a look at this wonderful design by Volkner Mobil, this German-made RV helps you park and hide your sportscar while you’re on holiday. Ever had the feeling where you’ve settled down at a camp site and just want to leave the children aside while you spend some time quality private time with your love one? Well this might just do the trick!

All vehicles under 16 ft in length can drive into the bay through a platform which slides the car beneath the RV into a safe mobile garage. This RV from Volkner was on display recently at the International Caravan Fair in Dusseldorf, Germany. New product

All vehicles under 16 ft in length can drive into the bay through a platform which slides the car beneath the RV into a safe mobile garage. This RV from Volkner was on display recently at the International Caravan Fair in Dusseldorf, Germany. New product

Update: Samsung F210 now available for pre-ordering

Posted by Videos at 11:08 PMThis is an update regarding Samsung’s latest handset set to soon launch in the UK, the F210. It is now official that the F210 will arrive the UK by 12 October (which is this friday!).

However if you can’t wait and want to reserve your bid for it, it is possible to order it now via Vodafone, there are no extra charges for pre-ordering and delivery is free, the tariff to come with your pre-order will be a 12-month contract, costing ?40 a month with 500 minutes and 500 texts.

The world’s largest indoor swimming pool located in Japan

Posted by Videos at 11:07 PMOk, so this topic may not be entirely related to technology nor is it really gadget-related, but just look at those stunning photos!

This is now the world’s largest indoor swimming pool also known as the Ocean Dome, located at the Phoenix Seagaia Resort Hotel in Japan, it’s got the capacity to hold up to 10,000 people!

Sansa View – SanDisk’s new video media player!

Posted by Videos at 11:04 PM

Here’s some news about a soon to arrive video / mp3 player to look out for, SanDisk’s latest version of Sansa View!

Following the news about the launch of redesigned new iPods and iPod Touch, SanDisk decided it was also time to tell the world about their newly improved media players. The new Sansa Views has been redesigned with a new 2.4-inch, 320×240 pixels screen, if you can recall the old Sansa View which was abit chubby both in size and thickness, this new one will instead be more comfortable to hold in the palm of your hands.

The new Sansa View will support video formats like MPEG4, WMV and H.264, it will also come bundled with a converter software, allowing you to convert DivX formats for viewing.

As you can see in the pic above, at just 0.35″ thin, it will be a convenient handheld media player / device, along with a battery that SanDisk has claimed to be able to last up to 7 hours of video play and 35 hours of music play.

Additionally, the new Sansa View will be available in 8 Gb and 16 Gb. Although it isn’t available to the UK yet, based on its pricing, what you pay for a 8 Gb Sansa View will only get you a 4 Gb Apple iPod, which is about $149 USD, equivalent to approximately £73 pounds.

Following the news about the launch of redesigned new iPods and iPod Touch, SanDisk decided it was also time to tell the world about their newly improved media players. The new Sansa Views has been redesigned with a new 2.4-inch, 320×240 pixels screen, if you can recall the old Sansa View which was abit chubby both in size and thickness, this new one will instead be more comfortable to hold in the palm of your hands.

The new Sansa View will support video formats like MPEG4, WMV and H.264, it will also come bundled with a converter software, allowing you to convert DivX formats for viewing.

As you can see in the pic above, at just 0.35″ thin, it will be a convenient handheld media player / device, along with a battery that SanDisk has claimed to be able to last up to 7 hours of video play and 35 hours of music play.

Additionally, the new Sansa View will be available in 8 Gb and 16 Gb. Although it isn’t available to the UK yet, based on its pricing, what you pay for a 8 Gb Sansa View will only get you a 4 Gb Apple iPod, which is about $149 USD, equivalent to approximately £73 pounds.

Would you pay $5000 for a leather-made ThinkPad Reserve Edition laptop?

Posted by Videos at 11:02 PM

Found a post about a $5000 ThinkPad Reserve Edition leather laptop currently on sale, apart from having a leather exterior, the mechanics inside are just your average specs. 160 Gb hard drive, 2 Gb memory, 2.2 Ghz Intel Core 2 Duo, DVD writer and a 12.1″ screen. Would you consider buying this laptop? (it’s special! :] )

One million Wii consoles sold in the UK in just 38 weeks!

Posted by Videos at 11:01 PM

Nintendo Wii has taken the record for becoming the fastest selling video game console in the UK ever, with one million consoles already sold in just 38 weeks. This is certainly a record for the books, as the last record was by Sony who sold the same equivalent amount but took 50 weeks. While last but not least, XBox 360 needed 60 weeks to attract the same number of customers!

Danilo Mangini’s new “Lobster” multimedia device

Posted by Videos at 11:00 PM

The pics below show the concept idea of a new upcoming multimedia device designed by Danilo Mangini called the “Lobster”. Strange look? Maybe so, but the name describes it fairly well, the segmented pieces of each module makes it easily recognisable as a lobster’s tail.

As you can see in one of the pics above, the “Lobster” isn’t just an mp3 player, it has quite alot of different ‘attachable’ functions too. The LCD screen in the middle acts as a base for the variety of modules that are plugged in, like cardiometer, etc…

Personally I think this concept is very unique, once this device gets on sell, people could separately buy new independent modules of their choice, kind of like getting add-on extensions for your Firefox browser

As you can see in one of the pics above, the “Lobster” isn’t just an mp3 player, it has quite alot of different ‘attachable’ functions too. The LCD screen in the middle acts as a base for the variety of modules that are plugged in, like cardiometer, etc…

Personally I think this concept is very unique, once this device gets on sell, people could separately buy new independent modules of their choice, kind of like getting add-on extensions for your Firefox browser

Confirmed: O2 to bring UK’s exclusive Apple iPhone deal!

Posted by Videos at 10:59 PM

Its finally been announced that O2 will be the single, exclusive carrier for the iPhone in the UK. We’ve all been waiting for a few months to confirm this news, with the choice of European service providers that are available, understandably this deal certainly wasn’t an easy one to close! It was said that the European carriers who have managed to close a deal for the iPhone had to even campaign for it via personal talks with Steve Jobs himself!

It is very clear that Apple has the intention to limit the iPhone’s sales and distribution to other countries as much as possible, O2 will be the exclusive carrier for the iPhone in the UK, while Orange will be the same in France, while T-Mobile for Germany. All three providers have agreed to share 10% of calls and data charges with Apple, while none of them will be able to subsidize these handsets to customers signing for the telephony contract.

As for now, it will not be until next year, before the Apple iPhone will be released in other European countries and Asia.

It is very clear that Apple has the intention to limit the iPhone’s sales and distribution to other countries as much as possible, O2 will be the exclusive carrier for the iPhone in the UK, while Orange will be the same in France, while T-Mobile for Germany. All three providers have agreed to share 10% of calls and data charges with Apple, while none of them will be able to subsidize these handsets to customers signing for the telephony contract.

As for now, it will not be until next year, before the Apple iPhone will be released in other European countries and Asia.

USB Gadget: Airplane fan to keep you cool at your desk!

Posted by Videos at 10:58 PMHere’s a neat little USB gadget you can show off in front of your colleagues at work, an airplane fan. Unfortunately, it does not fly and therefore can’t fetch your paperwork for you! :]

LocalCooling.com fight global warming from your desktop!

Posted by Videos at 10:57 PMOk, so the topic of this post has very much been in everyone’s mind in the recent years, what’s more this software isn’t necessarily just for tree-huggers! Anyone can pitch-in to help reduce global warming directly from your desktop with LocalCooling. I have been waiting for something this meaningful for a long time, this new piece of “green tech” software effectively helps you reduce power usage from your Windows XP pc when its idle. What’s more is that it gives you an estimate of how many Watts your monitor, hard drive, CPU, graphic card and other hardwares are Select from preset options or click “advanced” to customise for your own.

More after the jump…

Weird or not so weird? – Sony Ericsson bluetooth watches

Posted by Videos at 10:55 PM

The idea may not seem absolutely brilliant, but this is not the first time launch of bluetooth watches. Sony Ericsson previously launched the MBW-100 last year, now its been announced that a MBW-150 will soon be available in the UK.

Why would you use a bluetooth watch? Well the idea is actually quite simple, link it to your bluetooth mobile phone, if in any situation your phone is out of reach or you’re trying to avoid someone’s call but want to find out who’s calling, just check the screen on your watch!

Why would you use a bluetooth watch? Well the idea is actually quite simple, link it to your bluetooth mobile phone, if in any situation your phone is out of reach or you’re trying to avoid someone’s call but want to find out who’s calling, just check the screen on your watch!

Could this be PSP 2

Posted by Videos at 10:54 PMIt’s been confirmed that Sony will be launching a new revised version of PSP worldwide in September. Though the screen size is the same and it still uses UMD, this new edition is expected to be lighter and 19% slimmer. The battery will also be more efficient, this will certainly improve game loading time. MaxConsole suggests that the biggest new feature is probably the new portable’s ability to produce high quality video output. However many users would actually prefer a second analog stick!

Skyfire 2.0: The best Android web browser

Posted by Videos at 10:52 PMI’m sure that you already know how awesome Android OS is, but you’ll have to agree that Android wouldn’t be the same without its apps. This time there is a new application for Android and it is called Skyfire 2.0.

“Pod Cowboy” for iPod Shuffle from Digital Cowboy unveiled

Posted by Videos at 10:52 PM

Here is the latest in fashion accessories for the iPod Shuffle in Japan, it seems to follow the design of school bags which many Japanese primary school children use. This piece of accessory though has a bigger price tag than most iPod protective cases you would buy, it’s been claimed to be a perfect fit and is certainly a more attractive and competitive casing over ones you would be able to find on eBay for example.

Creative Inspire S2 Wireless 2.1 Speaker System

Posted by Videos at 10:51 PM

One of the things no geek can ever get enough of is entertainment, if you want a good quality entertainment package either from your tele / PC, you need a crucial component not worth sacrificing – sound system. We recently received one of Creative’s mid-price range speaker systems, the Inspire S2. Its a 2.1 setup and some of you may have seen its non-wireless equipped version, this system however has been packed with bluetooth connectivity, so here’s our quick review and overall impression of the system.

MSI GE600: Latest gaming notebook

Posted by Videos at 10:48 PM

Notebooks have always been a huge must have, but we all know that not all notebooks are suitable for gaming. Well MSI wanted to change that and it has announced that it will release new gaming notebook named GE600.

Lenovo ThinkPad W701ds Mobile Workstation with dual screen

Posted by Videos at 10:48 PM

Here’s LogicBUY’s latest gadget deal of the day for a Lenovo ThinkPad W701ds mobile workstation. The Lenovo ThinkPad W701ds is the dual screen version of the ThinkPad W701, which has a second 10.6-inch retractable screen for 39% more display area. Featuring high processing and memory capacities, as well as professional graphics that will allow 3D modeling and other tasks to be easily accomplished.

HP All-in-One 200t 21.5-inch desktop

Posted by Videos at 10:47 PM

Here’s LogicBUY’s latest gadget deal of the day for a HP All-in-One 200t desktop. The All-in-One 200t is ready to streamline your life and there’s no need for a separate PC tower

Memristors: A Flash Competitor that Works Like Brain Synapses

Posted by Videos at 10:40 PM

Last week, I read a lot about HP's advances with the memristor. This is a new class of tiny switch that could eventually change some of the fundamental ways computing devices are designed, and I am very intrigued. In theory, at least, the new technology could allow for a replacement for NAND Flash memory, maybe for DRAM and hard drives, and maybe even for logic at some point. It's fascinating technology—but of course, the path from theory to commercial product is often longer and more complex that it initially appears.

Memristors, or memory resistors, were postulated initially by Leon Chua of the University of California, Berkeley, back in 1961. Essentially, the idea is that there should be a fourth device, alongside resistors, capacitors, and inductors. You could put different amounts of electrical current through the device that corresponded to different states, and the device would remember that state even after the current disappeared. In other words, it could function as non-volatile memory. Since then, the scientific community has periodically discussed memristors, but no big company seemed to take it seriously until HP announced in 2008 that it had figured out how to actually build the devices.

Last December, HP published a paper in the "Proceedings of the National Academies of Science" that detailed a new architecture with which researchers could build a three-dimensional array of memristors and address each element. Thus, it can store and read large amounts of information, according to R. Stanley Williams, senior fellow and director of HP's Information and Quantum Systems Lab.

Memristors, or memory resistors, were postulated initially by Leon Chua of the University of California, Berkeley, back in 1961. Essentially, the idea is that there should be a fourth device, alongside resistors, capacitors, and inductors. You could put different amounts of electrical current through the device that corresponded to different states, and the device would remember that state even after the current disappeared. In other words, it could function as non-volatile memory. Since then, the scientific community has periodically discussed memristors, but no big company seemed to take it seriously until HP announced in 2008 that it had figured out how to actually build the devices.

Last December, HP published a paper in the "Proceedings of the National Academies of Science" that detailed a new architecture with which researchers could build a three-dimensional array of memristors and address each element. Thus, it can store and read large amounts of information, according to R. Stanley Williams, senior fellow and director of HP's Information and Quantum Systems Lab.

Velocity Micro Raptor Z90

Posted by Videos at 10:39 PM

The Velocity Micro Raptor Z90 ($5,499 direct) is VM's latest member of the $5k club to grace our bench. Like previous Raptor gaming desktops, it's a monster in both size and performance. It's filled with high-end gaming components, including an Intel Core i7-980X processor and two ATI Radeon HD 5970 video cards. It's not quite as sexy as systems like the Maingear Shift ($6,399), but it performs on the game grid. Take a look at the Z90 if you absolutely need high-performing components in your gaming box, and you have the bankroll to support it.

Design

The Raptor's chassis is one of Velocity Micro's extended signature cases, which we've seen on several VM systems. It's your standard large box with a side window for showing off the video cards, liquid cooling for the processor, and hard drive sleds. The wiring is neat and well hidden, plus the hard drives plug into a backplane, eliminating the need for separate cables for each drive. It looks like every other system we've seen from VM in the past six years: I guess if it ain't broke, don't fix it.

The system maintains enough room to fit the two ATI Radeon HD 5970 video cards, plus room for another, but as far as I know there's no benefit (or support) for three 5970 cards simultaneously. A PCI slot shares the same real estate as the free PCIe x16 slot, so you must choose between one or the other. The system has three free DIMM slots (to support the triple-channel processor and motherboard) as well as three free slots in its hard drive cage. You can add up to three more hard drives by simply connecting them to a hard drive sled and sliding it into the cage. The aforementioned backplane handles all the hard drive cable connections.

Features and Performance

Features

The Z90 comes with 6GB of DDR3 SDRAM and two drives: a 64GB SSD for the OS and apps, and a 1TB spinning hard drive for everything else. The SSD is certainly speedy, but 64GB is on the small side. You'll have to uninstall large games to make space for new purchases, unless you install apps and games to the 1TB data drive. There's also a BD-ROM/DVD±RW combo drive.

Performance

Velocity Micro Raptor Z90

Because the Raptor is a gaming system, you'd expect it to perform near the top of its class. And you'd be right. The Raptor's CPU is overclocked to 4.21 GHz, and the twin ATI Radeon HD 5970 video cards have four GPUs worth of computing power at your disposal. Translation: the Raptor Z90 can play our most strenuous tests smoothly, whether Crysis, World in Conflict, or our multimedia tests.

This is a solid system, if one that lacks the innovation and chart-topping performance other gaming PCs like the Maingear Shift

Design